For most of the last century, the centres of higher education and science were in the West. The United States, Britain, and Europe produced the world’s leading universities and research culture. Students from across Asia travelled there for advanced study, and knowledge flowed mainly in one direction.

But today, Asia is no longer just a consumer of knowledge - it is becoming a global leader in creating, shaping, and sharing it. China, India, South Korea, Japan, Singapore, and Malaysia are investing heavily in research, innovation, and higher education.

This shift is one of the most significant global transformations of our time. Yet with success comes a warning. As Asia rises, it must avoid the trap of imitation - trying to copy Western universities rather than building its own path.

World leaders

Asian universities were once seen as second choice compared to Harvard, Cambridge, orStanford. Today, that view is outdated.

China is now the world’s largest producer of scientific papers and leads in artificial intelligence (AI), clean energy, and biotechnology. South Korea and Japan remain powerhouses in technology and engineering. India’s institutes of technology and science fuel its growth in IT, pharmaceuticals, and space research.

Singapore has become a global research hub, while Malaysia and Thailand are positioning themselves as regional education centres. These countries are no longer just following global trends – they are helping define them.

So, how did the countries that were once followers end up becoming leaders today? The answer lies in investment and policy.

China spends over 2.5% of its GDP on research and development. South Korea spends nearly double that, the highest in the world. Singapore has invested billions in AI, biotechnology, and sustainability research.

Governments across Asia also have clear strategies – China’s “Double First Class” project, India’s “Institutes of Eminence,” and Malaysia’s higher education blueprint all aim to create global-class universities. These policies are not just about prestige; they are about national growth, technological independence, and global competitiveness.

Rankings trap and the Harvard illusion

Over-focusing on global rankings, however, can prove detrimental. Rankings measure things like citations, faculty-student ratios, and reputation surveys. These indicators can be useful, but they do not capture everything that matters.

A university that trains community doctors or develops affordable green technologies may have far greater impact than one that climbs 10 spots up a ranking list. Adopting Western standards too rigidly can undervalue research in local languages or work addressing community issues. Academic excellence must serve society, not just Western determined metrics.

Another danger lies in the desire to become “the Harvard of Asia”. Harvard is a product of American history, wealth, and culture. Simply copying its name, structure, or traditions will not recreate its success.

Asia’s greatest universities will be those that are confidently Asian – rooted in local realities but connected to the world. Rather than imitate Western models, Asian institutions should build on their own strengths: cultural diversity, rapidly growing economies, and the need to solve pressing regional challenges such as climate change, food security, and equitable healthcare.

Culture, freedom, and identity

Asia also possesses a rich intellectual heritage that can guide the future of its universities. Concepts such as ren (humaneness) in Confucian thought, gotong-royong (community cooperation) in Southeast Asia, ahimsa (non-harm) in Indian philosophy, and wa (harmony) in Japan provide deep foundations for education.

These traditions emphasise moral character, social responsibility, and balance – values often missing in purely market-driven Western academic models. If Asian universities draw from their own philosophical roots, they can build institutions that value not only knowledge and innovation but also wisdom, ethics, and community.

Rather than importing Western culture, they can offer the world an alternative vision of human-centred, responsible higher education. Education in Asia has long emphasised respect for teachers, community belonging, and collective success. These are powerful strengths. Replacing them with purely individualistic or hyper-competitive models could dilute what makes Asian education distinctive.

A different vision of success

Asia’s rise in higher education is not about copying the West – it is about creating something new to redefine what “world-class” truly means. That includes:

> Research that addresses Asia’s real challenges.

> Education that forms character as well as skills.

> Partnerships that are global but rooted in local values, philosophies and priorities.

The shift in global knowledge is not a battle between East and West. Western universities will remain influential, but Asia now plays an equal, and sometimes leading, role.

Collaboration, not competition, will shape the next era of global education. The question is not whether Asia can match Harvard or Cambridge, but whether it can succeed without losing its identity. The future of education will belong to those who innovate with confidence in their own foundations.

Governments, however, must guard against over-control. Innovation requires intellectual freedom - the ability to question, debate, and explore without unnecessary restriction. Balancing national goals with academic independence will be a key test for Asia’s universities in the coming decade. Asia’s universities have already shown they can rise. Their next challenge is to rise wisely.

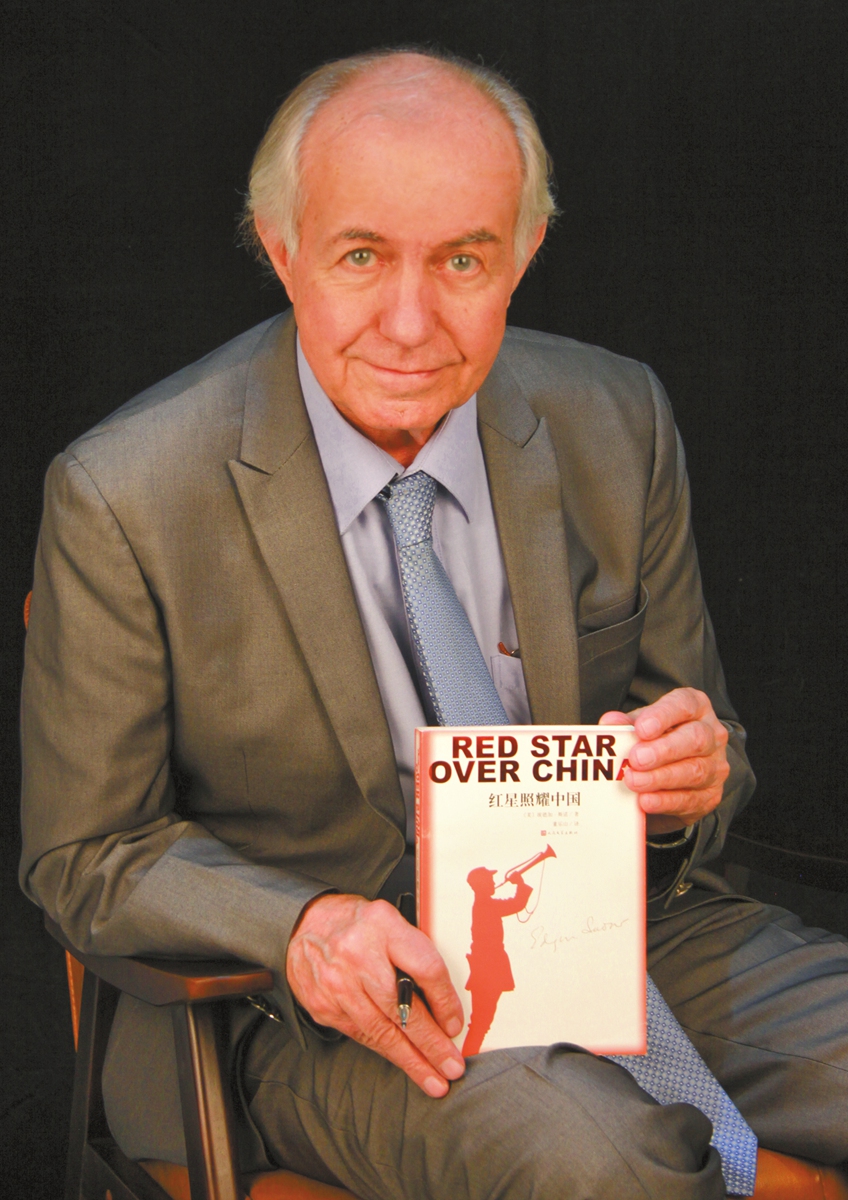

Prof Dr David Whitford is vice-chancellor and chief executive of University of Cyberjaya. He earned a doctorate from Cambridge University and has held leadership roles in medical education. With over 70 research publications on disadvantaged communities and quality healthcare delivery, his academic journey includes positions at the Royal College of Surgeons in Ireland, in Dublin and in Bahrain, where he established community-based teaching and led postgraduate studies. The views expressed here are the writer’s own.