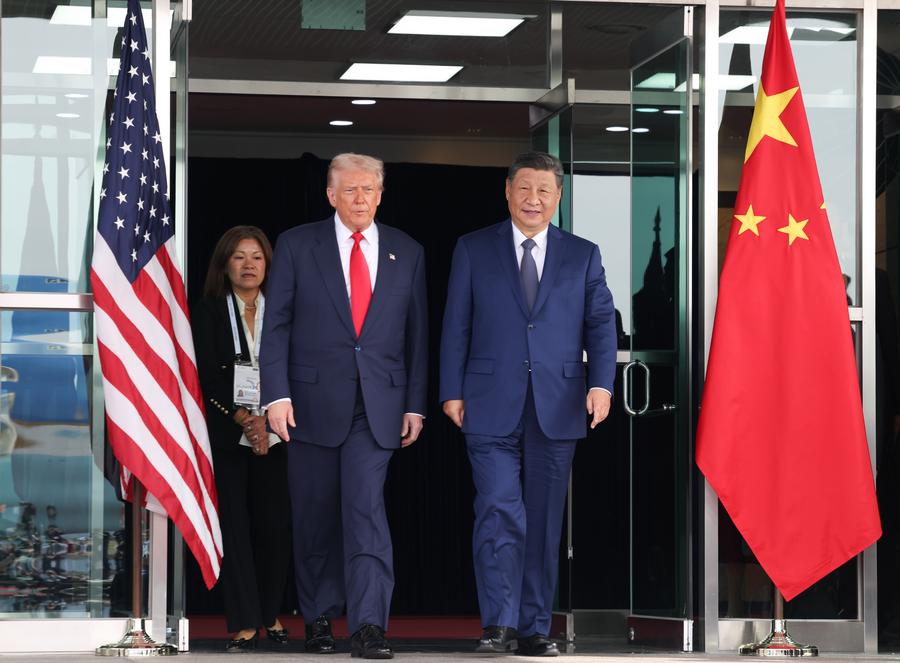

Chinese President Xi Jinping meets with U.S. President Donald Trump in Busan, South Korea, Oct. 30, 2025. (Xinhua/Huang JBy Xinhuaingwen)

Chinese President Xi Jinping said here Thursday that he is ready to continue working with U.S. President Donald Trump to build a solid foundation for bilateral ties, and create a sound atmosphere for the development of both countries.

In a meeting with Trump, Xi said under their joint guidance, China-U.S. relations have remained stable on the whole.

"China and the United States should be partners and friends. That is what history has taught us and what reality needs," he said.

Given different national conditions, the two sides do not always see eye to eye with each other, and it is normal for the two leading economies of the world to have frictions now and then, Xi added.

"You and I are at the helm of China-U.S. relations," said Xi. "In the face of winds, waves and challenges, we should stay the right course, navigate through the complex landscape, and ensure the steady sailing forward of the giant ship of China-U.S. relations."

Xi said that there is a good momentum in China's economic development, adding that in the first three quarters of this year, China's economy increased by 5.2 percent, and import and export trade in goods with the rest of the world expanded by 4 percent.

This is not an easy accomplishment given the domestic and external difficulties, Xi noted, adding that the Chinese economy is like a vast ocean, big, resilient and promising.

"We have the confidence and capability to navigate all kinds of risks and challenges," Xi added.

Chinese President Xi Jinping meets with U.S. President Donald Trump in Busan, South Korea, Oct. 30, 2025. (Xinhua/Shen Hong)

At its fourth plenary session, the 20th CPC Central Committee deliberated over and adopted the recommendations for the economic and social development plan over the next five years, Xi said.

"Over the past seven decades and more, we have been working from generation to generation on the same blueprint to make it a reality. We have no intention to challenge or supplant anyone. Our focus has always been on managing China's own affairs well, improving ourselves, and sharing development opportunities with all countries across the world," he added.

Describing that as an important secret to China's success, Xi said China will further deepen reform across the board, expand opening up, and promote higher-quality economic growth while achieving an appropriate increase in economic output, and advance well-rounded human development and common prosperity for all, adding that this will also expand the space for cooperation between China and the United States.

Xi noted that the two countries' economic and trade teams had an in-depth exchange of views on important economic and trade issues, and reached consensus on solving various issues.

He called on the two teams to work out and finalize the follow-up steps as soon as possible, and ensure that the common understandings are effectively upheld and implemented, to inject confidence into the two countries as well as the global economy through solid deliverables.

China-U.S. economic and trade relations have experienced ups and downs recently, and this has also given the two sides some insights, Xi noted.

The business relationship, Xi said, should continue to serve as the anchor and driving force for China-U.S. relations, not a stumbling block or a point of friction.

The two sides should think big and recognize the long-term benefit of cooperation, and must not fall into a vicious cycle of mutual retaliation, he added, calling on the two teams to continue their talks in the spirit of equality, mutual respect and mutual benefit, and continuously shorten the list of problems and lengthen the list of cooperation.

Dialogue is better than confrontation, Xi said, adding that China and the United States should maintain communication through various channels and at various levels to enhance mutual understanding.

There is good potential for the two countries to work together on combating illegal immigration and telecom fraud, anti-money laundering, artificial intelligence, and responding to infectious diseases, he added.

The competent departments should strengthen dialogue and exchanges and carry out mutually beneficial cooperation, Xi said, adding that the two countries should also engage in positive interactions on regional and international platforms.

"The world today is confronted with many tough problems. China and the United States can jointly shoulder our responsibility as major countries, and work together to accomplish more great and concrete things for the good of our two countries and the whole world," he added.

China will host APEC 2026, and the United States the G20 summit next year, Xi noted.

The two sides can support each other in making both summits productive to promote world economic growth and improve global economic governance, he added.

Chinese President Xi Jinping meets with U.S. President Donald Trump in Busan, South Korea, Oct. 30, 2025. (Xinhua/Huang Jingwen)

Noting that it was a great honor to meet with Xi, Trump said China is a great country and President Xi is a well respected great leader, with whom he has been good friends for many years and has always got along well.

The United States and China have always had a fantastic relationship, and it will be even better, said Trump, voicing his hope for an even better future for both China and the United States.

China is the biggest partner of the United States, and with joint efforts, the two countries can get many great things done for the world and have many years of success, said Trump.

China will host the 2026 APEC Economic Leaders' Meeting, while the United States will host the G20 Summit next year, said Trump, wishing both sides every success in these important events.

The two presidents have agreed to enhance cooperation in economic, trade, energy and other fields and to encourage more people-to-people exchanges.

They have also agreed to maintain interactions on a regular basis. Trump looked forward to visiting China early next year, and invited President Xi to visit the United States.

Chinese President Xi Jinping landed in Busan on Thursday to attend the 32nd APEC Economic Leaders' Meeting in Gyeongju, and ...

Why this APEC meeting is drawing so much attention: Global Times editorial

Against the backdrop of global economic uncertainty, rising protectionism and accelerated technological transformation, how should we write "Asia-Pacific's tomorrow"? "Chinese wisdom" and "Chinese solutions" have become one of the focal points of attention at this APEC meeting.